Hydration (HydraDX)

DeFi

HydraDX is built as a parachain – specialized blockchain in the Polkadot network. It is benefiting from shared security, speed and flexibility of the Substrate framework while remaining optimized for a single purpose: enabling fluid programmable value exchange.

Related Project:

Basilisk

Basilisk

Basilisk

Basilisk

Tokens: HDX

W3F Grants:

Status

Announced

Testing

Parathread

Polkadot

Coretime

Status: ACTIVE

Leased Core ID: 32

End Date:

Mar 8, 2026

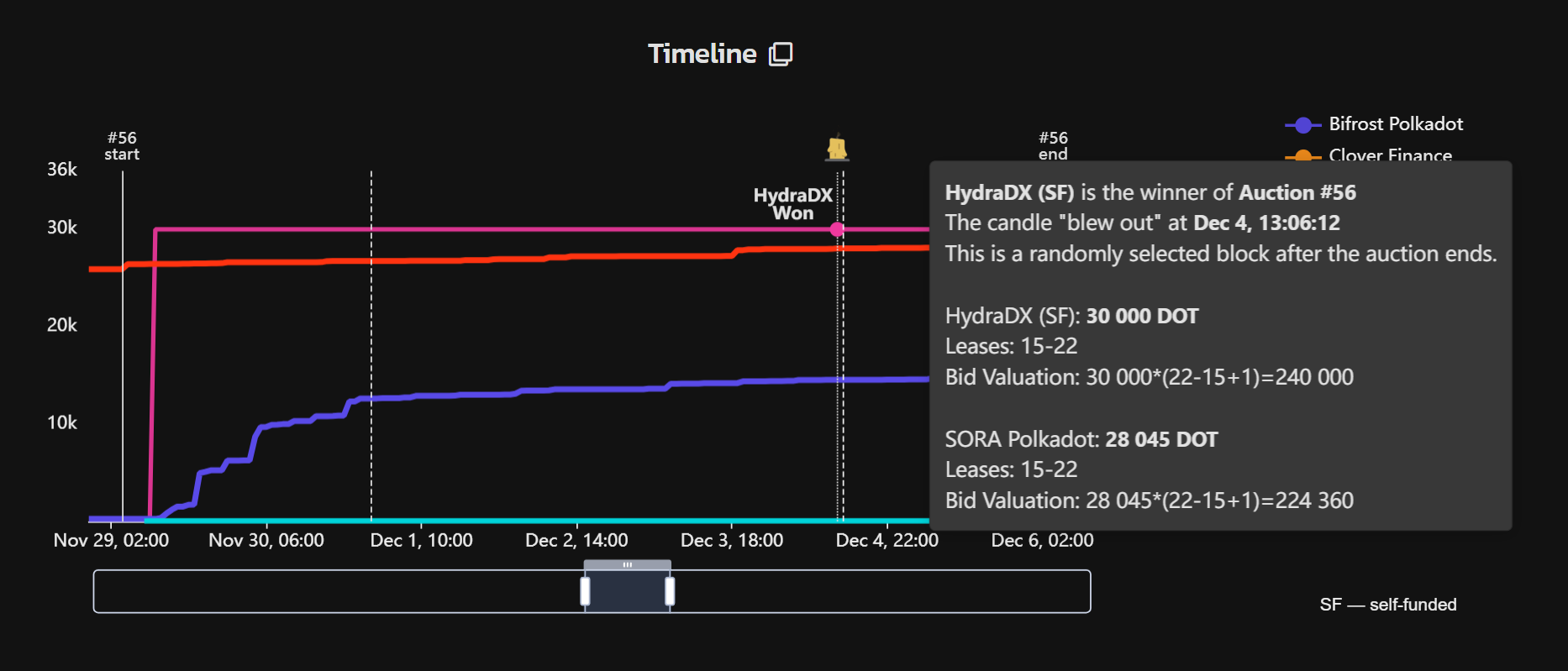

Auction 9: WINNER

Leasing: March 16, 2022 - January 16, 2024

Crowdloan ID:

2034-25

Funds Raised: 2 462 543 DOT ($3 225 931)

Leading Blocks:

100%

Project Auction Info:

crowdloan details

Reward:

1 DOT :

12.5+

HDX

Crowdloan Cap: 8 000 000 DOT

Reward Pool: 1b of 10b (10%)

- HDX rewards will be distributed linearly

- Notes:

- the target of HydraDX is to win Auction #9

- contributions made before HydraDX is leading the race by 15% will receive between 280 and 125 HDX per DOT

- contributions made after HydraDX is leading the race by 15-25% will start dropping linearly

- contributions made after HydraDX is leading the race by 25% will receive between 28 and 12.5 HDX per DOT

Partners (2)

Videos (4)

Developer Activity

If you have a connection to this project, kindly Contact Us to keep the details current

Primary Token:

HDX

Total Supply:

10 000 000 000

Crowdloan Reward Pool:

1 000 000 000 (10% of Total Supply)

HDX Distribution

News

.png )