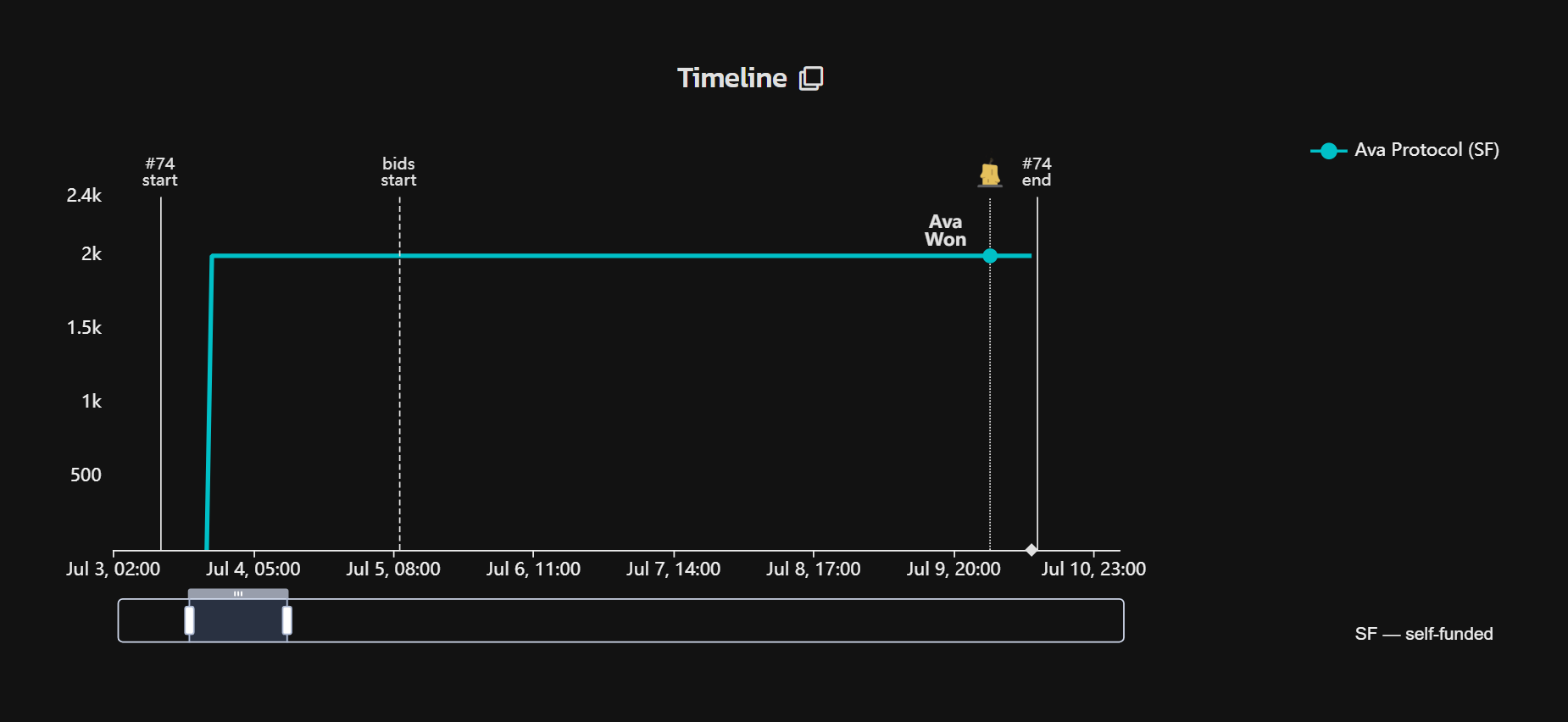

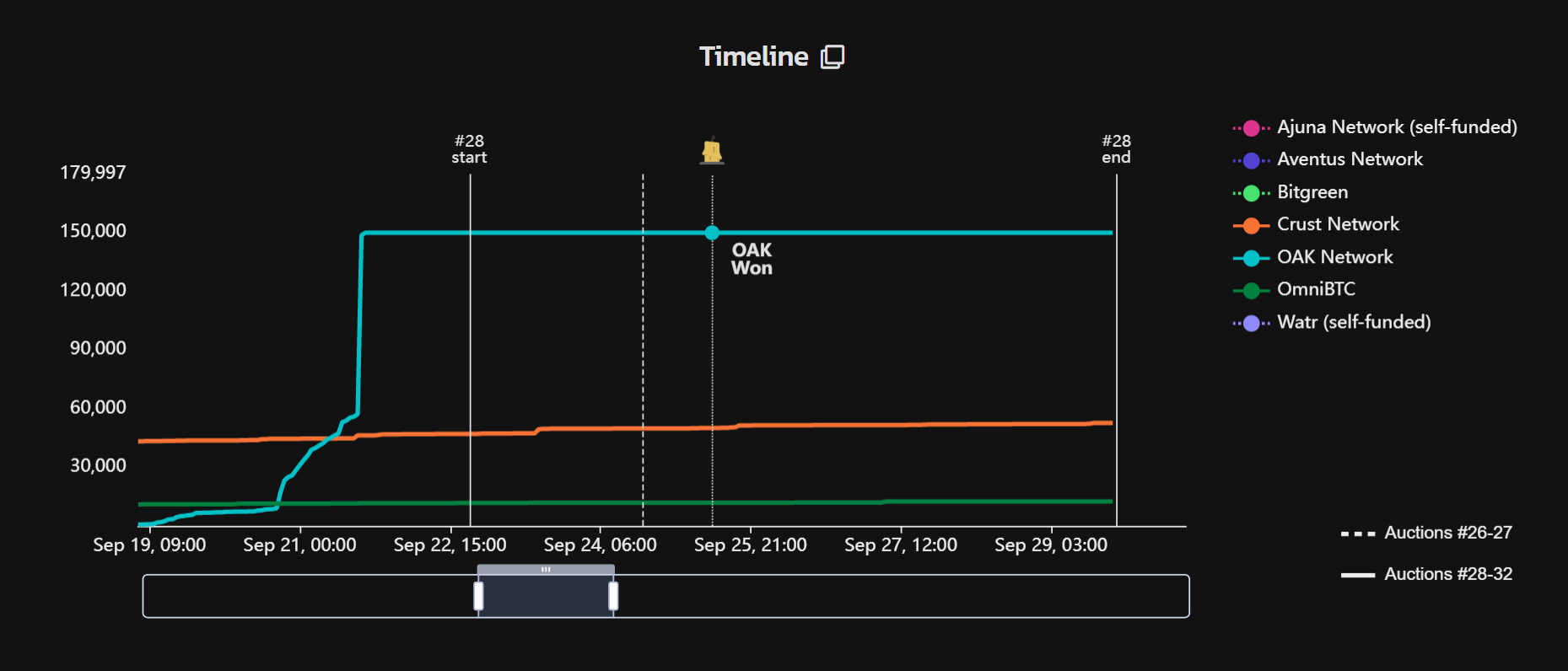

Ava Protocol (OAK Network)

OAK Network, the Web 3.0 hub for Defi and payment automation, closed a $5.5M Seed round led by Foundation Capital, Greylock, and Hypersphere Ventures. Other notable participants in the funding round include Electric Capital, Monday Capital, GSR, Shima Capital, Blockwall Digital, and angel investors.

One of the great opportunities in blockchain is the concept of “programmable money.” The ability for entrepreneurs to create, trade, and use digital assets globally will likely be as impactful as when people were first able to create and consume information globally via the web. That said, today, most transactions on blockchain are simple, one-time events. If you want to do anything more sophisticated — for example, commit to a future transaction at a future price — it is complicated, expensive, and often not secure. Use cases like recurring payments, buy/sell orders based on on-chain events or price movements, or swapping between chains have previously been mostly inaccessible due to cost or technical complexity.

OAK Network is solving this problem by building the web3 hub for DeFi and payment automation through an easy to use event driven transaction model built on Polkadot.

Turing Network

Turing Network

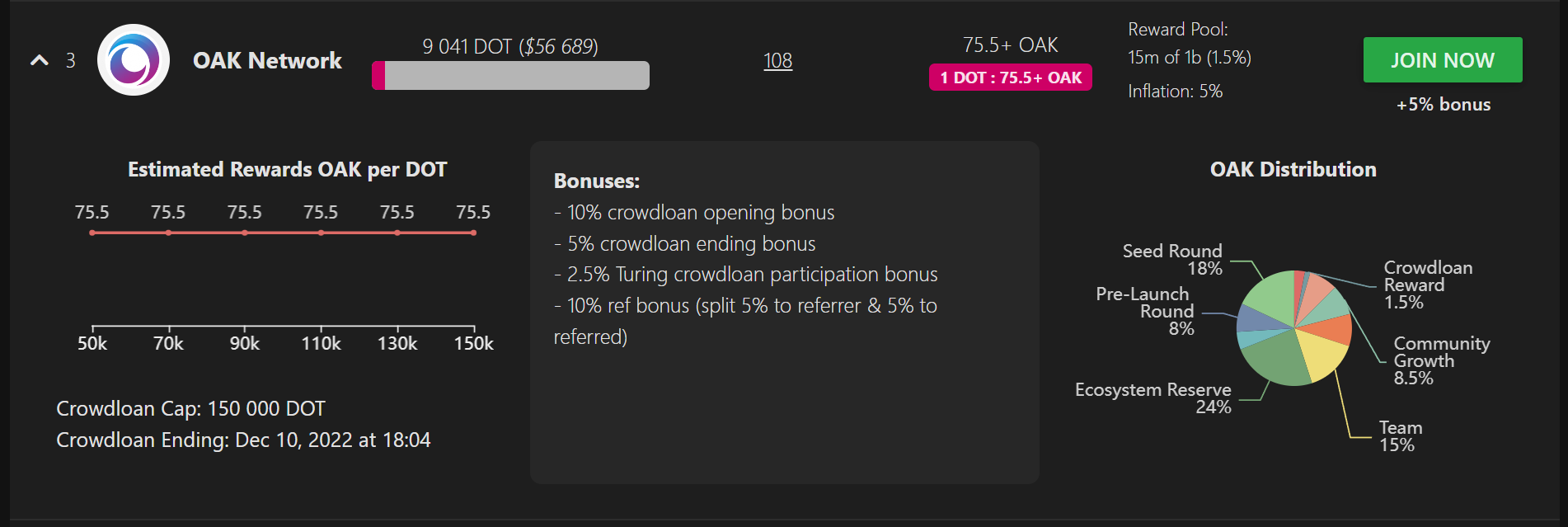

- 10% crowdloan opening bonus

- 5% crowdloan ending bonus

- 2.5% Turing crowdloan participation bonus

- 10% ref bonus (split 5% to referrer & 5% to referred)

Substrate Blockchain Framework

Substrate is a good technical fit for OAK. By building on top of this framework, we can leverage the extensive functionality that Substrate includes out-of-the-box, rather than building it ourselves. This includes peer-to-peer networking, consensus mechanisms, governance functionality, an EVM implementation, and more.

Overall, using Substrate will dramatically reduce the time and implementation effort needed to implement OAK. Substrate allows a great degree of customization, which is necessary in order to achieve our Ethereum compatibility goals. And, by using Rust, we benefit from both safety guarantees and performance gains.

Polkadot Network and Ecosystem

As a parachain on Polkadot, OAK will be able to directly integrate with — and move tokens between — any other parachains and parathreads on the network. We can also leverage any of the bridges that are independently built to connect non-Polkadot chains to Polkadot, including bridges to Ethereum. Polkadot’s interoperability model uniquely supports OAK’s cross-chain integration goals and is a key enabling technology to support the OAK vision.

But perhaps just as important as the technical criteria above, we are impressed with the people in the Polkadot ecosystem. This includes individuals at Parity, the Web3 Foundation, and other projects in the ecosystem. We have built many valuable relationships and find the people to be both extremely talented and the kind of people we want to be around.

What makes OAK network unique?

Our mission is to empower high-level business model innovations with a smart contract engine redesign at low-level. By solving critical problems from the bottom up, we can unleash product potential not possible today. With original solutions on batch operation, access control and resource management, OAK VM will introduce new smart contract features while staying EVM-compatible, all to expand the feasibility of a blockchain application. In addition, OAK will offer developer tools to streamline the setup and troubleshooting process, enabling more powerful and versatile applications to be built.

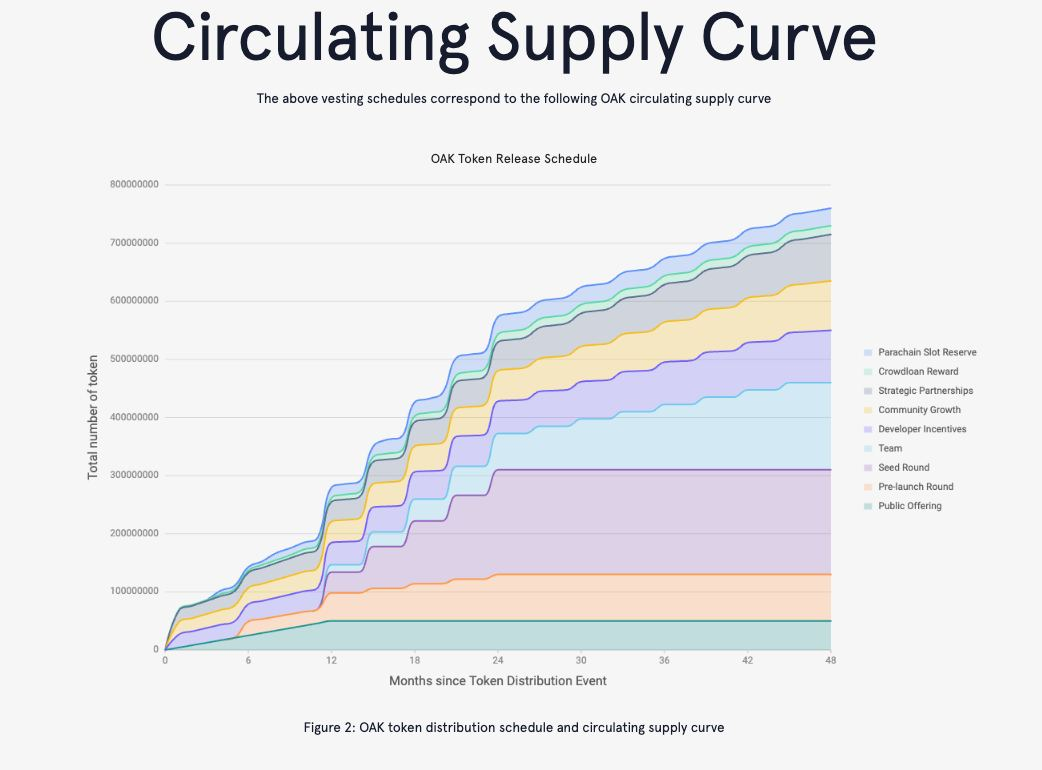

How many OAK tokens are there in circulation?

OAK's circulation supply will be 33.43%, 56.83%, 73.73%, 90.63% of the initial total supply, 1 billion tokens, for the first four years, respectively. Due to OAK’s inflationary monetary policy, the number of tokens is expected to increase 10% per annum, with Validator rewards depending on the staking rate and the remainder going to the network treasury alongside transaction fees to dynamically adjust the incentive to participate in staking.

What about the governance of OAK blockchain?

The development of OAK is also decentralized, governed by a distributed community of OAK token holders, a Council, and a Technical Committee. To make changes to the network, the idea is to combine OAK token holders and the Council to administer network upgrade decisions.

Active OAK token holders can propose a referendum on changes to the network by bonding their tokens (depositing a minimum amount to a proposal) for a certain period and vote on the proposals of others. Proposals that gather the highest amount of bonding support will be selected first in the next voting cycle. Tokens are then unbonded once proposals have been brought to a vote.

The Council is an on-chain entity, elected by OAK token holders and responsible for both proposing changes and determining which changes are made. It also manages the development treasury from the network fees collected and provides representation for passive OAK holders in the ecosystem. Council member proposals require fewer votes for approval than those by ordinary OAK holders.

The Technical Committee is then composed of the development teams that are building the OAK network. Along with the Council, it can make special proposals in an emergency with fast-tracked enactment times and is elected by Council members.Whether a proposal is made by the public OAK holders or the Council, it will have to go through a referendum to let all OAK holders, weighted by stake, make the final decision.

How Is the OAK Network Secured?

OAK uses NPoS (Nominated Proof-of-Stake) as its consensus mechanism, designed with the roles of Validators and Nominators to maximize chain security.

Validators secure the network by staking OAK to run validating nodes and perform full verification of the Relay Chain. They also participate in consensus with other Validators to come to agreement on the true shared state of the network, rejecting any invalid transactions. They add new blocks to the OAK blockchain and receive incentive rewards in return.

The OAK network provides validation rewards equally to all Validators, regardless of their stake. Staking rewards are then distributed pro-rata to all stakers after the Validator payment is deducted, incentivizing a more equally-staked set of Validators.

Nominators are active OAK token holders who don’t want to take on the cost and responsibility of other roles in the network but still help to secure the blockchain by staking OAK and selecting good Validators in return for a share of the staking rewards. This incentivizes increased participation in network security and careful Validator selection as if Validators misbehave (go offline, attack the network, or run modified software), both Validators and Nominators will get slashed, losing a percentage of their staked OAK.

.png )